A New York Times conference featured a bank chief pushing the financial industry for tracking Americans who shop at retailers and monitoring their “suspicious activities” using a Suspicious Activity Report. This was under the guise “reducing gun violence.”

The Suspicious Activity report is the first step in gun control

Andrew Ross Sorkin interviewed Priscilla SIMS Brown, CEO of Amalgamated Bank, as a special guest at the Times DealBook confab. He is the Times’ columnist, who proposed the overall gun-buying monitoring scheme.

He also outlined the “next steps”, in a column that highlighted Sims Brown’s efforts following an international financial standards board adopting her petition to create tracking codes.

Even a small amount of thought can reveal the serious flaws in the plan. Implementing the massive system to track private financial transactions will raise a lot of privacy and civil liberty issues. It is also ripe for abuse.

Gun Control Dragnet

Sims Brown lobbyed the International Organization for Standardization to create a gun-related Merchant Category Code. This code is used by credit and debit card companies to track gun and ammunition purchases.

The proposal was approved by the ISO and banks are now using them. Sims Brown’s predictions of the future reveal her true gun control goal. It’s a dragnet that harms law-abiding Americans.

Sims Brown stated that they are still in the early stages of this project to Sorkin and the rest of the audience. These scenarios will be used as the implementation continues.

She refers to “those scenarios” as “detection scenarios” where a purchase prompts a bank or other institution to file a Suspicious Activity report to the Treasury Department’s Financial Crimes Enforcement Network.

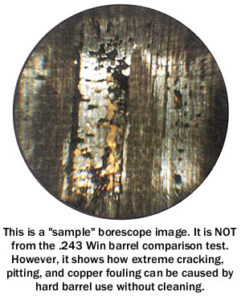

Here’s how MCC tracking is supposed to work. The new code is assigned for purchases made at retailers that sell ammunition or firearms. The MCC will not identify what is in the customer’s basket.

It could include a complete purchase of a firearm and several boxes ammunition. It could also include a tent, sleeping bag and propane stove. A flag could be deemed “suspicious” if the total cost is higher than usual due to an unusual purchase history. However, it doesn’t necessarily make it dangerous.

According to media reports, the proposal will not have the intended effect.

Bloomberg News reported that the payment network and its banks partners would not know if a gun-store customer purchases an automatic rifle or safety gear.

Banks are not able to say what purchases would be “suspicious.”

Only a Steppingstone

The MCC scheme has also caught the attention of Congressional gun-control politicians. H.R. 5764 by Reps. Madeleine Dean and Jennifer Wexton (D.Va.) as well as in the U.S. Senate with S. 3117 by Sens. Edward Markey (D-Mass.) Elizabeth Warren (D.Mass.) ).

The Gun Violence Prevention Through Financial Intelligence Act would give banks the ability to track purchases. This is done by requiring that the Treasury Department’s Financial Crimes Enforcement Network provide the “guidance”, necessary to establish the MCC.

Rep. Wexton stated that financial institutions have a legal responsibility to have programs in place to detect and report suspicious activity. However, they must be able to identify what they are looking for.

Rep. Dean also praised the backdoor gun control effort.

She stated in a release that “Financial institutions already possess proven systems to identify suspicious purchasing patterns and behavior”

Yet, no one has yet to offer any information about “suspicious behaviour” or “purchasing habits” that would be eligible for a flag. There are many questions, few answers, and Constitutional rights are at risk.

Trudging ahead Trampling Rights

Sorkin extols his contribution to the MCC code.

He stated to the Dealbook audience that “this is an emotionally charged topic for me… because back in 2018, I started writing about guns in our society… as well as the role of banks and credit card companies in financing mass shootings.”

Sorkin stated that he believes lawful firearm retailers and the federally-regulated Federal Firearms Licensees, which allow for the legal exercise the Second Amendment, should work together to create a backdoor database of gun buyers. Congress is prohibited from doing this on its own.

Sorkin wrote that merchants should use the code and not confuse transactions with other classifications. “The payments industry must develop and refine software algorithms to identify suspicious activity …”.

There are these words again: “suspicious activities.”

Those who compile lists of Americans exercising their Constitutional Second Amendment rights should be resisted. The ability to purchase at the retail counter is the first step to the right to keep and bear arm.

However, financial industry leaders are changing their roles to facilitate legal transactions into credit scores that place Americans on secret watchlists.

The financial industry does not have to be suspicious about gun buyers. They are already subject to FBI National Instant criminal background check system (NICS) verifications. Americans should be suspicious of “woken” bank CEOs who do the bidding of gun control lawmakers.

Story originally posted to NSSF.org

Continue Reading

Are you still having trouble finding what you were looking?

Search

Personal Defense World’s first article, Use Cash: Banks Use Suspicious Activity Record as Gun Control Dragnet, appeared first on Personal Defense World.